Investment Philosophy

Investment Objectives

...Met by combining Fundamentals & Workout strategies to achieve superior risk adjusted returns

Portfolio Return > Benchmark

Generate returns higher than benchmark through superior investment selection and portfolio construction

Capital Protection

Protect portfolio from permanent loss of capital

Calculated Risk

Don't believe in buying lottery tickets in a quest to chase performance

Stability > Volatility

Keeping the journey smooth to protect investors from unnecessary downside volatility during market falls

Clearview Long Term Partners Fund

Our flagship investment approach catering to high net-worth individuals and institutions with investments predominantly in Indian equities

Fundamental

Good quality business available at reasonable price with triggers for value convergence

Learn More+

Workouts

Predictable special situations which are delinked from the market and have limited downside risk but have upside optionality

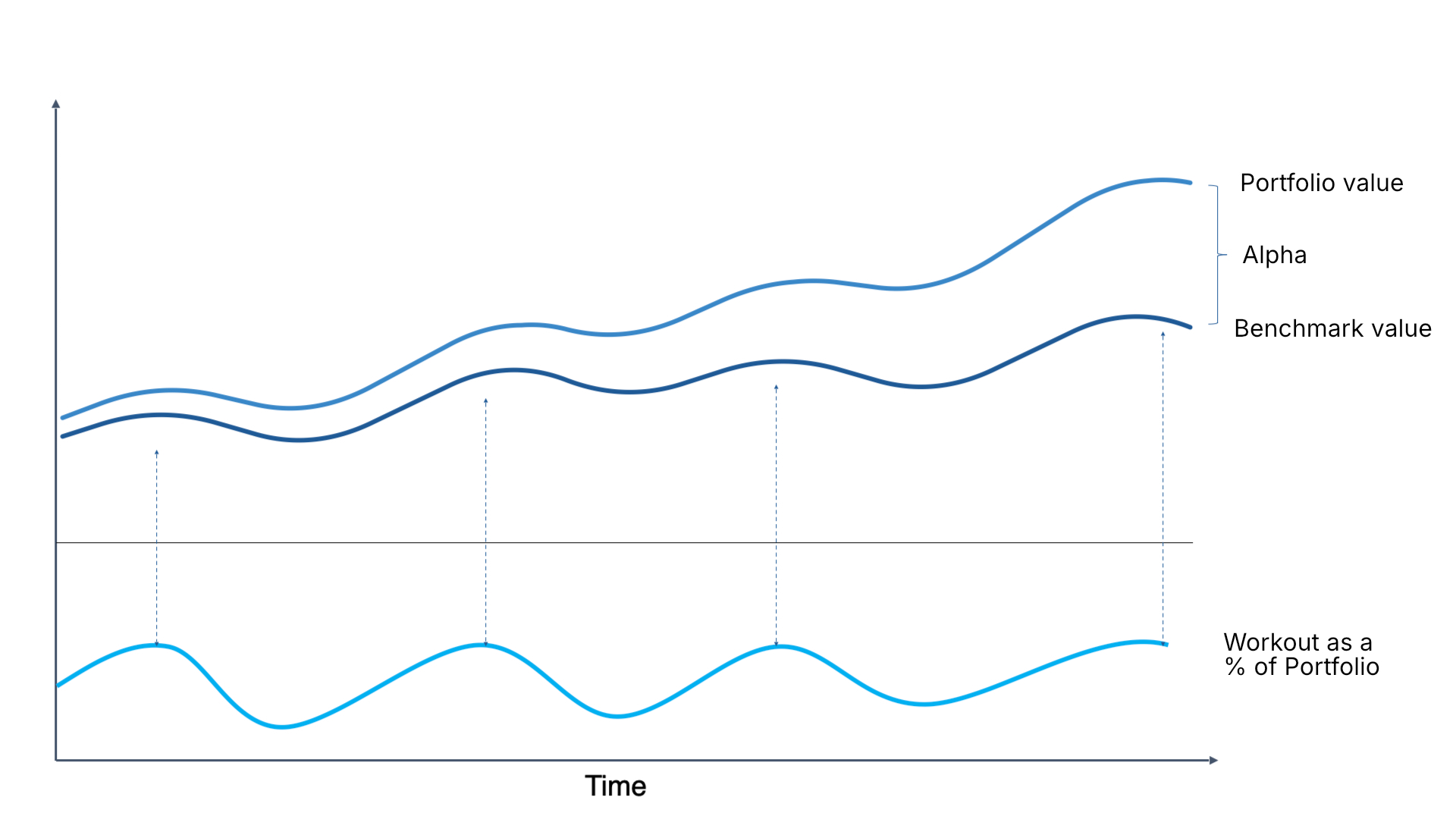

Learn MoreCombination of fundamentals and work-outs results in superior risk adjusted returns

Workouts % in Portfolio increases when trade-off between risk and reward seems unfavourable. Higher % of Workouts enables

Resilient portfolio with reasonable returns during market downturns

Cash conservation for fundamental ideas when risk-reward turns favorable

Alpha generation during all seasons

Fundamental Investments

Private Equity Style Investing

Good Quality Business

Competitive & Sustainable Moat

Ensure ROCE > Cost of Capital over the competitive advantage period

Management & Governance

Integrity & competence of management with protection of minority shareholder interests

+

Reasonable Price

Absolute > Relative

Prevents us from acting during market euphoria when 'any' price can be justified

Margin of Safety

To protect against unknown downsides

+

Triggers for

Value Convergence

Identify Trigger

Stocks can stay mispriced longer than one can stay solvent

Price -> Value

Events (capex, change in business strategy, management) can lead to convergence of price with value

Clearview Edge

Rich experience of assisting blue-chip Private Equity funds manage multi-billion dollar investments

Workouts

Special Situations

Investments whose outcomes are influenced by specific corporate actions like M&A, open offers, demergers etc.

Reasonable & Predictable

Price should allow for reasonable and predictable returns during holding period

De-linked from Market

Capital preservation during times of market euphoria when risk-reward is not in favour of fundamentals

Limited Risk

In-built downside protection despite industry / business changes and broader market movements

Clearview Edge

Team comprising of ex-investment bankers with rich experience in handling special situations

What to Expect from Us

Deep Research

Scientific research > Gut calls

Discipline & Contrarianism

Greedy when others are fearful and fearful when others are greedy

Low Portfolio Churn

Not cutting the flowers to water the weeds

Concentrated Portfolio

Extreme diversification is protection against ignorance

What Not to Expect from Us

Technical Analysis

No charting

Trading & Speculation

We don't buy stocks, we buy part ownership in a business

Short Termism

In the short run, the market is a voting machine, but in the long run, it is a weighing machine

View on Macros

Bottoms-up > Top-down

Address

Clearview Capital Advisors Private Limited

Unit 703, 7th Floor, 90 Degree Magnus,

Block EP, Sector V, Salt Lake City, Bidhan Nagar,

Kolkata - 700091

SEBI PMS Regn No: INP000009029

Call Us

+91 74397 25132

Mail Us

contact@clearviewcapital.in